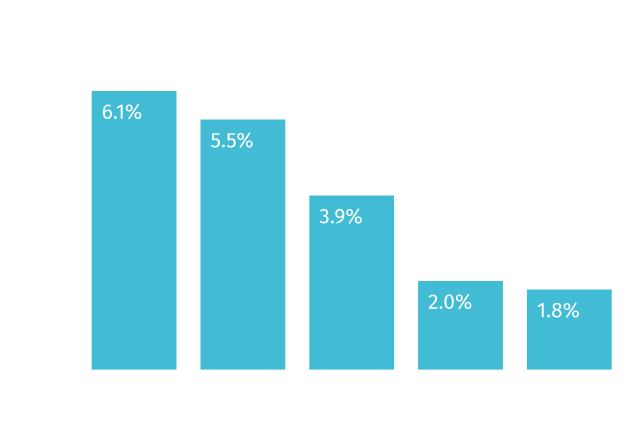

$10,000

Low Entry Barrier

12-14%

Targeted IRR

Inflation Hedge

Long Term Cash Flow & Capital Gains

$25,000

$10,000 Compounded Over 10 years Grows to Over $25,000

15%

Reduce Taxable Income Through Depreciation

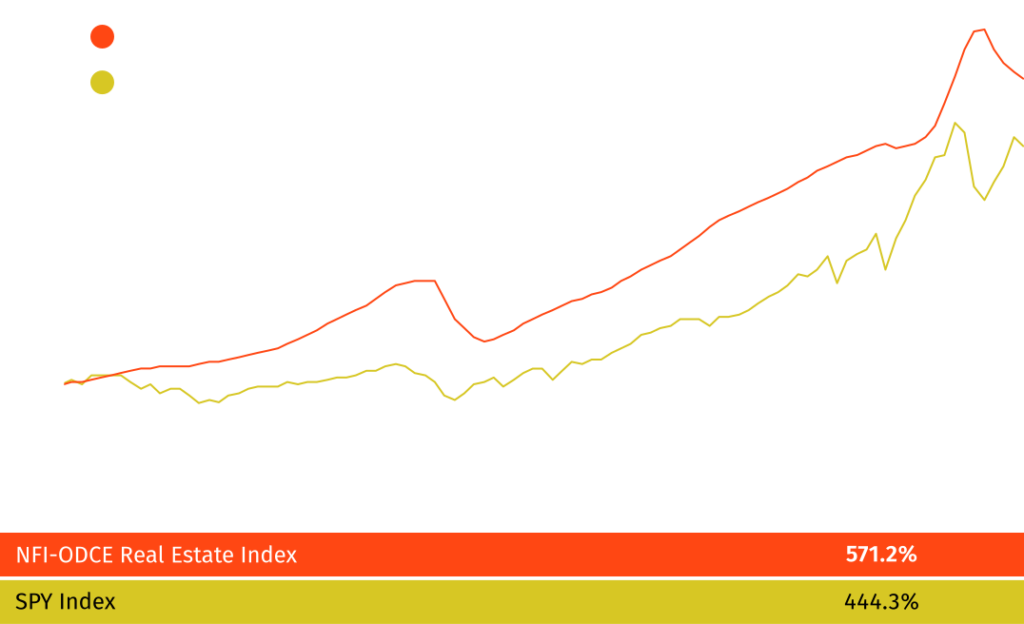

Diversification

Diversified Against The Broader Market