Low Entry Barrier

Targeted IRR

Long Term Cash Flow & Capital Gains

$10,000 Compounded Over 10 years Grows to Over $25,000

Annual Fixed Return Paid Quarterly

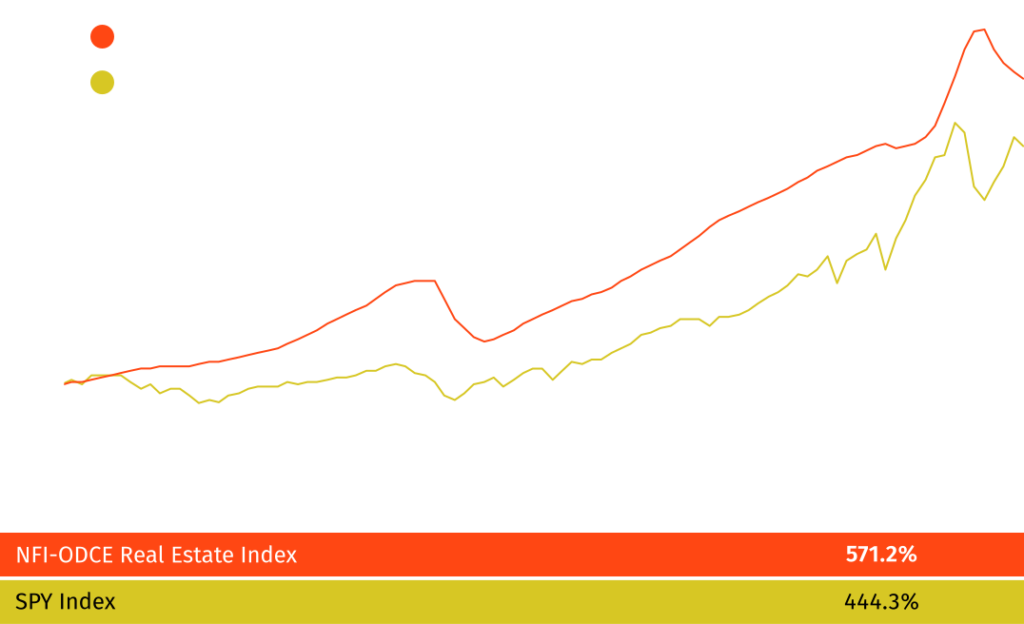

Diversified Against The Broader Market

Get Instant Access To The Private Offering Memorandum, Fund Presentation And All You Need To Know To Invest.

A veteran team of CRE professionals who understand changing market conditions and critical investment factors.

Deep experience identifying, selecting, acquiring and operating high-return investment properties.

Rigorous fundamentals research and analytics to find, enhance, and realize long-term portfolio benefits.

A focus on the private real estate sector for diversification and inflation hedging, mirroring how the wealthiest 1% invest.

A disciplined investment process framed by industry and population change seen through the lens of fair market value.

Predictable monthly income, stable returns, and mitigated default risk by leasing only to investment-grade tenants.

We believe that the diversification of real estate assets in the portfolio eliminates the correlation of performance to traditional asset classes such as equities and fixed income.

Shareholders are mitigated from environmental risks. The property operators assume all environmental liabilities.

Owners of shares do not bear any operating costs or other expenses associated with the operations of the properties.

The Fund provides a 10% annual fixed return, paid quarterly

Investments focus on long-term leases that offer long-term opportunities through expense control, property improvements, increased occupancy, and revenue growth.

The Fund continuously seeks to achieve newly appraised fair market value.

Windows are available for investors to redeem shares on an annual basis.

Established Leasehold Characteristics

Stable Rent Rates

Highly Competent Property Managers

Credit-worthy Tenants

3-5 Year Asset Hold Periods

Kalamazoo, MI

320,000 sq. ft.

Providence, RI-MA

248,000 sq. ft.

Orlando, FL

170,000 sq. ft.

Dallas, TX

132,000 sq. ft.

Richmond, VA

150,000 sq. ft.

Bakersfield, CA

180,000 sq. ft.

Corona, CA

90,000 sq. ft.

Phoenix, AZ

280,000 sq. ft.